Back

Blog

Small Business Forward Leads the Way in Prioritizing Impact Measurement among ESOs

Written by Kim Zeuli and Kathleen O’Shea, ICIC

Since 2014, ICIC has been a proud partner of JPMorgan Chase’s Small Business Forward initiative, a $150 million, multi-year global initiative to support women, minority and veteran-owned small businesses to help build their long-term success, creating local, inclusive economic growth.

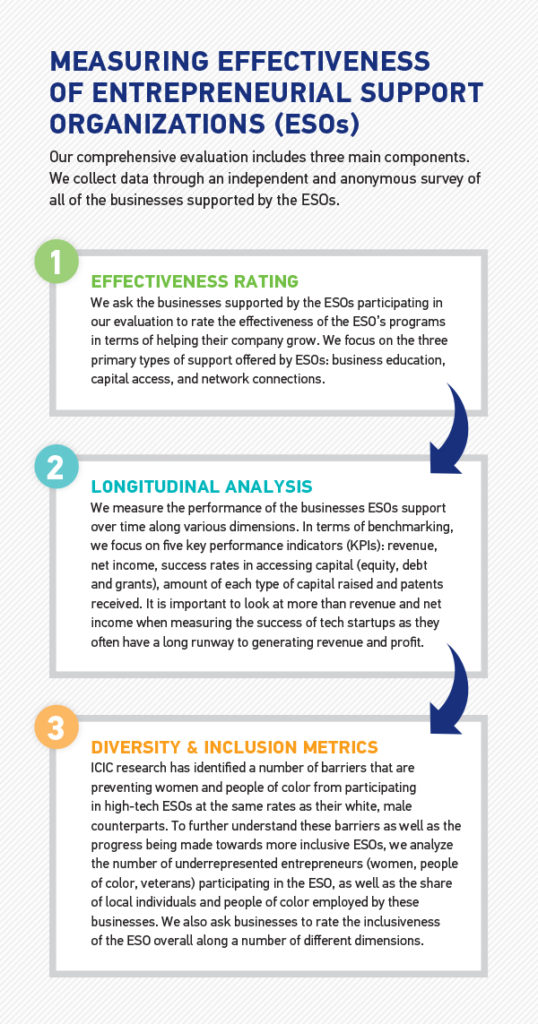

ICIC has developed a comprehensive, custom evaluation for Small Business Forward that measures the capacity and effectiveness of the entrepreneurial support organizations (ESOs) it supports. Our rigorous approach includes an independent, annual survey of the businesses that have received support from Small Business Forward ESOs (both currently and in the past). Now in its fourth year, our annual evaluation of these ESOs collects extensive data revealing new insights into the impact of their programs and the performance of the businesses they support.

Several of the ESOs supported by JPMorgan Chase are focused on the high-tech sector. They play a critical role in driving the growth of stronger clusters in their regions, supporting businesses in biotechnology and life sciences, cleantech, health IT, and other high-tech sectors. These sector-specific ESOs provide businesses access to tailored, powerful networks and help them access targeted capital.

The eight high-tech ESOs we evaluated in 2018 supported 646 businesses that raised just over $137 million in capital, generated nearly $115 million in revenue, and received 157 new patents. The businesses employed 2,504 people and paid nearly $97 million in wages.

Benchmarking Metrics for High-Tech ESOs

In 2018, we collected information from 308 businesses supported by eight high-tech ESOs. On average, the businesses are young and small: They have an average of 9.4 total employees and 67 percent are five years old or younger. Seventy-eight percent consider themselves to be concept, seed, or early-stage businesses.

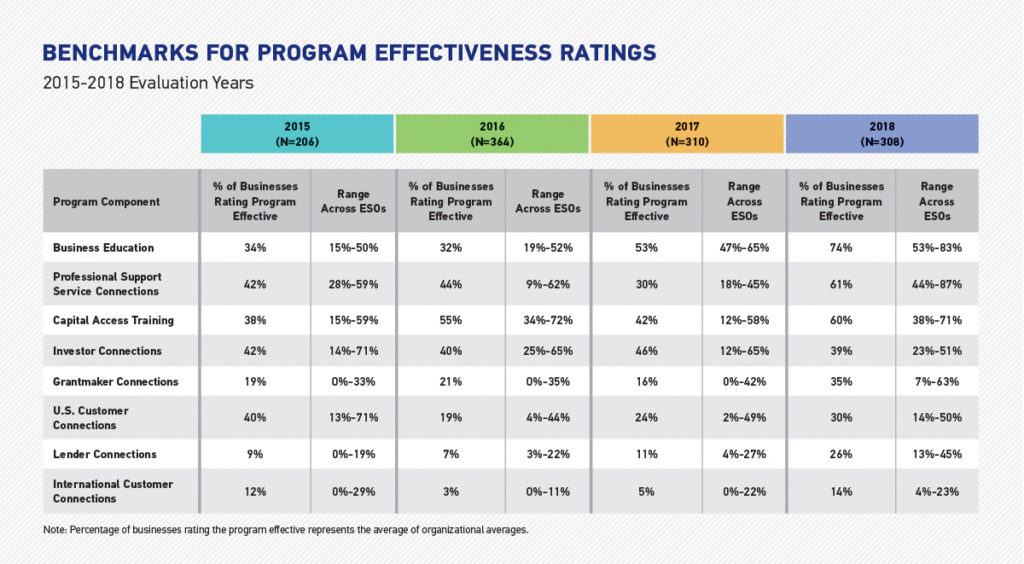

Program Effectiveness Ratings

We ask businesses to rate the effectiveness of the ESOs’ programs in terms of helping them grow. The responses are ranked in order from highest to lowest ratings for 2018. On average, the ESOs were rated as most effective at business education followed by connections to professional support services and capital access training. Connections to lenders and international customers are the weakest areas, on average, across all ESOs.

Small Business Forward continues to adapt its strategy to address such gaps. For example, it is improving access to loans through the Entrepreneurs of Color Fund, which supports community-based lenders in Detroit, Chicago, San Francisco, and the South Bronx to scale minority-owned businesses.

Our analysis also clearly shows how performance ratings vary across ESOs. For example, in 2018, with connections to grantmakers, the average rating for each organization varied from seven percent to 63 percent.

Overall, we observe higher program effectiveness ratings in 2018, with all but two of the ratings (investor connections and U.S. customer connections) improving since 2017. A number of the effectiveness ratings stand out for their marked increase across the four years: business education (34 to 74 percent), professional support service connections (42 to 61 percent), and capital access training (38 to 60 percent). While it is difficult to draw conclusions about these trends because the sample of businesses responding to the survey varies each year, this does demonstrate the strength of the Small Business Forward initiative in terms of identifying highly effective ESOs and continuing to build their capacity.

The ESOs are less effective at connecting businesses to new customers. This is an area where many ESOs struggle, and few dedicated intermediary organizations are focused on matching businesses to private contracting opportunities with large corporations, hospitals and universities. Ascend 2020, a new initiative developed by the University of Washington Foster School of Business’ Consulting and Business Development Center and supported by JPMorgan Chase, is focused on responding to this need, particularly for minority-owned businesses. In the six cities in which it is currently operating, local partners focus on connecting minority-owned businesses to procurement opportunities. In Chicago and Washington, D.C., Ascend 2020 supports a dedicated intermediary organization that matches qualified businesses to opportunities with large organizations in the market.

Key Performance Indicators

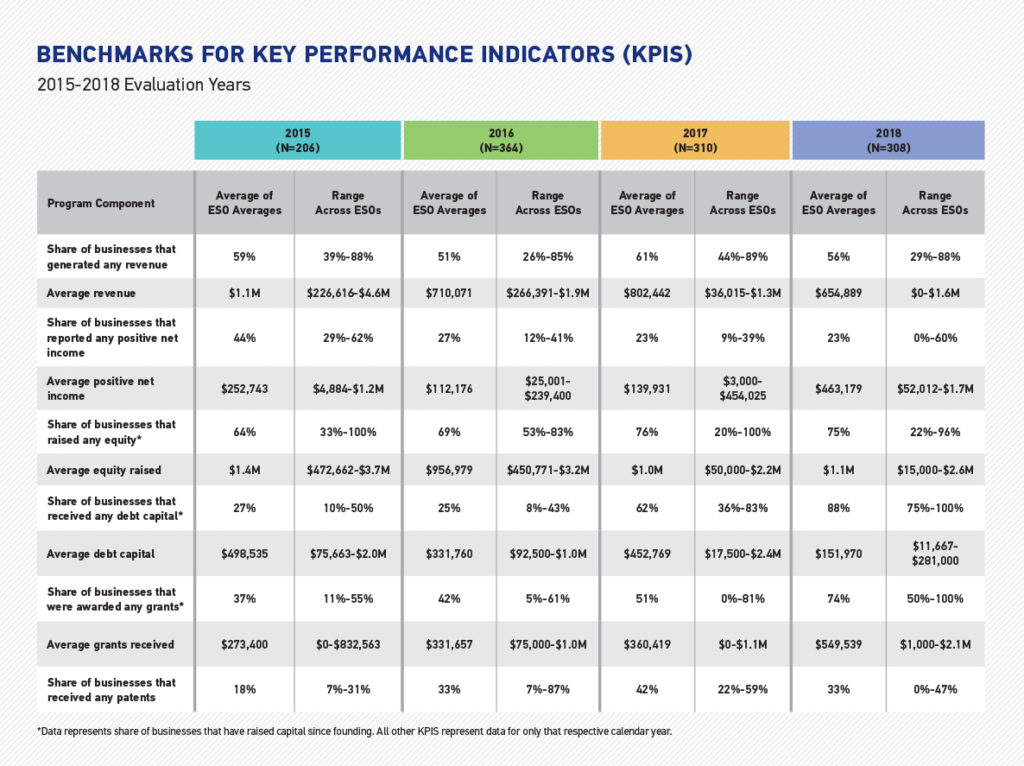

Given that most of the businesses in our sample are young, it is not surprising that in 2018, on average, just over half (56 percent) are earning revenue, but the majority (77 percent) are not yet profitable. In 2018, on average across all organizations, the businesses reported earning about $655,000 in revenue, but this varied widely across ESOs—with one ESO supporting only pre-revenue businesses, while another supports businesses with an average of $1.6 million in revenue.

The vast majority of the businesses seeking capital of all types have been successful. They were most successful at securing debt capital (88 percent success, on average), but about three-quarters also experienced success raising equity (75 percent on average) and securing grants (74 percent). The ranges in success rates and amounts of capital received highlight the fact that some organizations do not support businesses in finding and securing a specific type of capital, which may be attributed to differences in industry and business models.

Across the four years, the average revenue reported by the businesses has declined (from $1.1 million to about $655,000), but interestingly, average profits (positive net income) have increased (from about $253,000 to just over $463,000). These trends reflect the changing business sample that responded to ICIC’s survey, which prevents us from drawing strong conclusions from the survey year over year. For example, the 2018 sample may include both more early-stage (pre-revenue) businesses as well as more mature businesses that are reporting higher profits.

The share of businesses receiving debt capital increased from 27 to 88 percent since 2015, yet the average size of loans received has decreased significantly (from just under $500,000 to approximately $152,000). The share awarded grants has increased from 37 to 74 percent over the same time, and the average grant received has grown significantly (from $273,400 to nearly $550,000). By comparison success rates in raising equity and the average size of equity investments has remained relatively stable. The share of businesses receiving patents decreased slightly from last year, from 42 to 33 percent, but overall has increased since 2015.

Prioritizing Data Collection to Maximize ESO Impact

Our evaluation begins to fill a critical gap in measuring what effective business incubation looks like in the U.S. An increasing number of ESOs, including many supported by Small Business Forward, have sophisticated strategies in place for collecting and reporting data. Yet, many still have only informal processes or ad hoc tactics in place for quantifying impact. Regular surveying of businesses is time- and labor-intensive. Resources are often limited and ESO leadership may be reluctant to divert them away from programming. Additionally, many ESOs are newer organizations that may not yet have established systems to collect such data efficiently. Keeping an up-to-date record of business contacts, for example, can be extremely challenging even for a well-resourced organization.

It is critical that ESOs have access to the right tools and best practices to collect data and report on the unique impact of their organization. In 2019, ICIC and JPMorgan Chase will begin to equip Small Business Forward ESOs with the right strategies and tools necessary to measure their impact and communicate their value, especially with respect to diversity and inclusion. Small Business Forward will also continue to adapt its strategy by supporting promising new initiatives, such as Ascend 2020 and the Entrepreneurs of Color Fund, which help address critical gaps for entrepreneurs of color that have been highlighted in ICIC’s research and evaluation efforts. The goal is to ensure all ESOs are well positioned to further improve the effectiveness of their programming, strengthen the performance of businesses they support, and maximize their impact for all entrepreneurs.