Back

Blog

Connectivity: A New Place-Based Strategy for Distressed Communities

By Howard Wial, Senior Vice President and Director of Research, ICIC, and Christiana McFarland, Director, Center for Innovation Strategy and Policy, SRI

April 3, 2024

Distressed parts of Greater Cleveland follow all the typical patterns – high poverty rates, low educational attainment, and uneven broadband and transit access. Despite these challenges, poorer neighborhoods are drivers of the region’s tech-intensive Production Technology and Heavy Machinery industry cluster, manufacturing component parts for precision machinery. Manufacturing has a long history in the region, but more recent strategies by regional partners have ensured that living-wage jobs and innovation rich economic opportunities are well-distributed. In fact, 20% of jobs in the Cleveland region’s Production Technology and Heavy Machinery industry cluster are in highly populated areas of concentrated poverty and low income—places that ICIC defines as under-resourced communities (URCs). Programs and services such as employer-led training, child care, and the Job Hubs Plan, an initiative to coordinate hubs of business activity, civic resources, and transit, demonstrate pathways to building opportunity in distressed communities through regional economic connectivity.

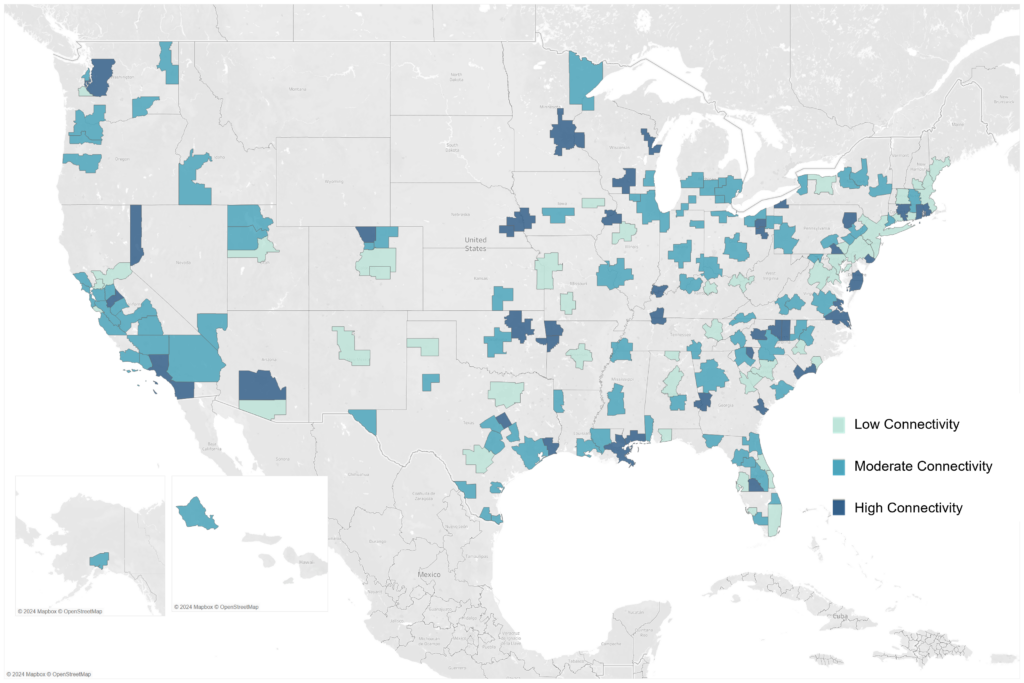

Regional economic connectivity is an economic, workforce, and community development strategy that focuses on industry clusters that are thriving in the broader region and establishing them within URCs. Regional economic connectivity can bridge the economic divide within regions by fostering connections between distressed communities and the more prosperous parts of their metropolitan areas. To better understand how well and under which circumstances distressed communities benefit from regional economic connectivity, ICIC and SRI examine geographic patterns of industry cluster employment in 181 metropolitan areas using a combination of data analysis and case study evidence. Our findings indicate significant opportunity for economic developers and their partners to target asset development and other strategic investments to grow regionally strong clusters in URCs.

Our new report, Regional Economic Connectivity: A Strategy to Build Opportunity in Distressed Communities, describes the features of economic connectivity, demonstrates how connectivity has been achieved for a diverse set of industry clusters in five metropolitan areas, and draws conclusions for economic development policy and practice.

Features of Economic Connectivity

Our analysis of connectivity identifies characteristics associated with higher levels of regional economic connectivity and, therefore, the contexts in which connectivity strategies have a stronger likelihood of success. Regional economic connectivity of URCs is more prevalent in small and medium-sized metropolitan areas (those with populations of less than one million). For example, among the 10 metro areas with the greatest economic connectivity (averaged across all clusters that are strong in their respective metro area), only two (New Orleans and Providence) have populations of at least a million, while most of the rest have populations below 500,000. Clusters that are highly specialized regionally, manufacturing-based clusters, clusters with low educational requirements for entry-level workers, and lower-wage clusters also have more connectivity. Within metros, suburban URCs are more connected than central city URCs; this is especially true for manufacturing-based clusters. The connectivity of service-based clusters, however, does not differ significantly between central city and suburban URCs.

These nationwide findings may not hold for all metro areas or all clusters. Therefore, we created an economic connectivity dashboard that shows the features of connectivity in each of the metro areas and clusters we analyzed. Economic developers can use the dashboard to identify the locations and clusters that offer the best opportunities to improve connectivity.

Implications for Economic Development Policy and Practice

Our profiles of connectivity in five geographic regions with various industrial compositions, sizes, and demographics offer deeper insights on region and cluster-specific contexts that affect the ability of URCs to generate growth and development from regionally competitive clusters and ways that economic developers and others can advance strategies for jobs in distressed communities with low barriers to entry and that offer living wages.

- Production Technology and Heavy Machinery in Cleveland-Elyria, OH.

- Communications Equipment and Services in Hickory-Lenoir-Morganton, NC.

- Education and Knowledge Creation in Fresno, CA.

- Insurance Services in Miami-Fort Lauderdale-West Palm Beach, FL.

- Information Technology and Analytical Instruments in Austin-Round Rock, TX.

From these cases we offer the following insights for the practice of economic development.

State and local governments and regional organizations should consider incentives and strategies structured to attract and retain cluster-related firms in URCs. Incentives, including workforce development, small business technical assistance, infrastructure improvements, and site preparation should be targeted toward fundamental business development challenges within URCs, toward firms that are part of strong regional clusters, and toward those that are located or planning to locate in URCs.

Attracting investment in URCs to develop regional economic connectivity requires special approaches for anchor institutions. If anchors, whether nonprofit or for-profit, are driving connectivity (as are higher education institutions in Fresno), they have special roles and responsibilities to train and hire URC residents, contract with URC businesses, and avoid or minimize gentrification and displacement of current URC residents. In so doing, they can attract other businesses and jobs to URCs.

Related clusters, especially those that include professional and business services or infrastructure, can be the basis for connectivity of other clusters. Some clusters support the growth of related clusters. In the Miami region, the Financial Services has grown recently as businesses relocated from northeastern major metros post-COVID. The growth of Financial Services helped spur the growth of the related Insurance Services cluster. Key strategies to support the development and connectivity of these complementary clusters are access to small business support services and programs such as Accelerate Miami-Dade to bridge the digital skills divide and expand access to job opportunities across industries.

By itself, the presence of regional cluster employment in URCs does not guarantee greater prosperity or opportunity for URC residents. To ensure that jobs in URCs are accessible to URC residents, a combination of workforce development, wrap-around services (such as child care, transportation, and career counseling) and employer commitments to hire residents is necessary. Many of the industries we profiled are tech- and innovation intensive, with opportunities for those with skills but less than a college degree. Employer-led workforce programs, such as CommScope University in Hickory, NC, support employment for local residents.

Read Regional Economic Connectivity: A Strategy to Build Opportunity in Distressed Communities for a deeper dive into our analysis and findings.