Back

Blog

Chicago institutions launch new program with potential to tackle major hurdles of impact investing

In April the MacArthur Foundation, Chicago Community Trust (CCT), and the Calvert Foundation announced Benefit Chicago, an innovative collaboration that aims to mobilize $100 million in impact investments for nonprofits and social enterprises in Chicago. By drawing on complementary experiences and capabilities of a private foundation (MacArthur), a donor-advised fund manager (CCT), and a Community Development Financial Institution (Calvert), the collaboration has potential to bridge major gaps in impact investing in and around the Chicago area.

Impact investing has gained steam in recent years, stepping into the global spotlight after a taskforce comprised of several G8 countries, now called the Global Social Impact Investment Steering Group, was announced in June 2013. A worldwide annual survey reported $77.4 billion in impact investing assets under management at the end of 2015. Looking ahead to early 2017, The Economist is holding a conference around how to “mainstream purpose-driven finance.”

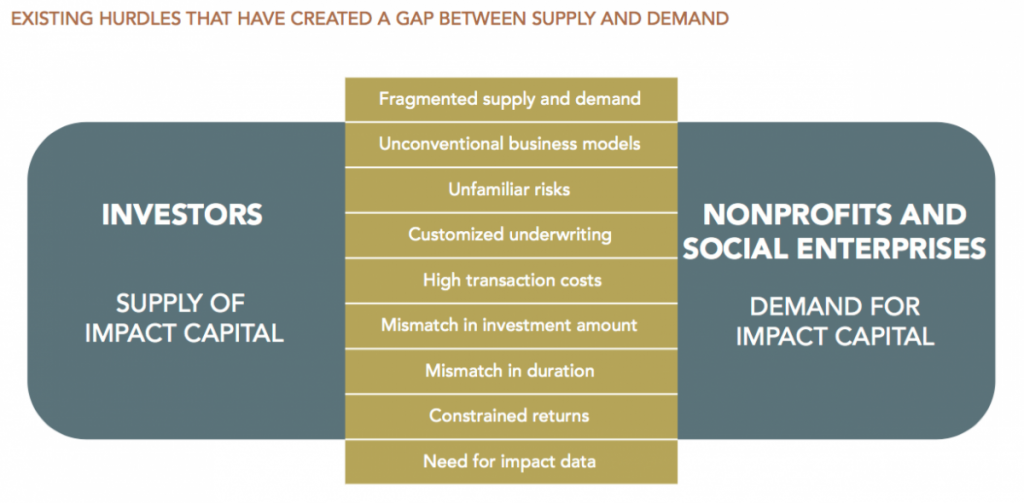

Despite this widespread momentum, the MacArthur Foundation and CCT identified considerable obstacles to the growth and success of the space, outlined in, “Bridging the Gap: Impact investment supply and demand in the Chicago region.” The hurdles include fragmented supply and demand, unfamiliar risks, a mismatch in investment amounts, constrained returns, and a mismatch in duration of investments.

In response, the MacArthur Foundation and CCT teamed up with the Calvert Foundation to launch Benefit Chicago, a new impact investment fund. MacArthur created and transferred $50 million of its own assets to the fund, alongside an inaugural $15 million, 15-year investment from CCT. Up to $50 million more will be sourced from the purchase of the Calvert Foundation’s Community Investment Notes®, fixed-income securities that mature over a period of one to fifteen years, and pay interest to investors annually. Calvert will loan the proceeds of the Notes to the Chicago Benefit fund. In total, the three entities hope to create a combined pool of capital worth $100 million.

The tri-party arrangement leverages philanthropic capital, which tends to be more patient in nature, with revenue generated through the sale of securities that mature in as little as one year. Combining philanthropic and private capital allows Benefit Chicago to invest in efforts that require a longer time horizon to produce social impact than traditional investors are willing to endure. Investors have the option to purchase Calvert’s Notes that mature in as little as 1 year or as long as 15 years, with interest ranging from 1% to 4% annually. This pooling of private dollars with foundation resources mitigates disconnects between short-term investor goals and longer-term capital needs of nonprofits.

“Many of the impact investors and traditional social sector investors invest for very short time horizons, and the problems that we are trying to solve have taken generations to develop,” explains Calvin Holmes, president and CEO of Chicago Community Loan Fund, a mission-driven, nonprofit community lender that will be seeking capital from Benefit Chicago once the fund begins making loans. “It takes long-term money to fix problems that were long in the making,” he said. “We expect Benefit Chicago will have the capacity to put 15-year money on the street, which we think is fantastic,” says Holmes.

Providing the opportunity for anyone to invest in the fund through Calvert’s Notes is another reason the venture is unique. This kind of accessibility opens the door for ordinary investors who want to make a direct investment in the Chicago community but don’t know where to begin. “Our goal is to provide a simple yet powerful way for everyone to make investments which, ultimately, benefit the dynamic, diverse city we love – making it a better place for all,” says MacArthur President Julia Stasch.

“We’re trying to, with this approach, to make it simple for investors of all kinds to participate, to make sure there’s powerful impact that’s meaningful to them, and also to make sure that the capital that is deployed is really useful to the social sector organizations, tailored to their particular needs,” she said.

Additionally, the model can help reduce the perceived risk of investing in social impact organizations. Benefit Chicago is responsible for vetting each organization that receives investments and for ensuring they follow through with repayment and reporting their impact. Putting that accountability on a third-party shifts a significant amount of risk away from investors.

In the short term, Benefit Chicago has potential to allow social enterprises in the Chicago area to spend less time competing for and securing capital, and more time carrying out mission-oriented activities, by providing opportunities for longer-term investments. It could also prove to be a strong motivator for individuals in the local community to participate, as it allows for varying levels of involvement through Calvert’s Notes. In the long term, the collaboration of different organizations modeled by Benefit Chicago could prove to be an alternative solution to mobilizing private sector investments for impactful social enterprises.