Back

Blog

Bipartisan Legislation Looks to Boost Private Investment in Distressed Communities

Too many American communities have been left behind by widening geographic disparities and increasingly uneven economic growth. We come from different parties and regions, but share the common conviction that all Americans should have access to economic opportunity regardless of their zip code.

- Joint statement, released February 2, 2017 by the legislators behind the recently reintroduced “Investing in Opportunity Act”

Sometimes it feels as though there is nothing our policymakers in Washington can agree upon. But amid the discord affecting our nation’s capital is a glimmer of hope: Senators Tim Scott (R-SC) and Cory Booker (D-NJ), and Congressmen Pat Tiberi (R-OH) and Rob Kind (D-WI) have reintroduced legislation that would incentivize the private sector to make long-term investments aimed at improving distressed communities.

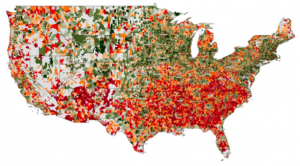

The bipartisan legislation, known as the “Investing in Opportunity Act” (IIOA), stems from a harsh reality: although the nation’s economy has improved, not all have benefited equally. According to the Distressed Communities Index, combining seven complementary metrics to present a multidimensional picture of economic distress, an estimated 50.4 million Americans live in economically distressed communities. Many areas continue to linger in recession. A report by the Washington-based Economic Innovation Group found that between 2010 and 2013, the average distressed zip code lost 6.7% of its jobs and 8.3% of its businesses, even as nearby zip codes prospered.

According to ICIC’s latest analysis, inner city residents represent 10% of the population and nearly a quarter of the population living in poverty live in the inner city. Inner cities represent 16% of U.S. unemployment, 22% of U.S. poverty, and 32% of U.S. minority poverty.

Although IIOA also targets investment in rural and suburban areas, the legislation will undoubtedly have a major impact on inner cities if passed.

If passed, the bill would boost inner city investment by:

- Allowing investors to temporarily defer capital gains realized from the sale of property if those gains are reinvested into qualified property located in an “Opportunity Zone”: For an area to be considered an Opportunity Zone, it must be a low-income census tract and nominated by the governor of the state in which the tract is located. Under the legislation, “property” is defined as stock, partnership interest, business property, or interest in a qualified investment fund.The ability to defer capital gains will result in a huge tax savings for property owners. By some estimates, U.S. investors currently hold $2.3 trillion in unrealized capital gains on stocks and mutual funds alone—a significant untapped resource for economic development. IIOA wants to unleash this capital back into distressed communities.

- Incentivizing long-term investment: The IIOA is structured to reward patient capital. It provides investors with a modest reduction in capital gains taxes when investments are held for at least five years, with the reduction growing the longer the investment is held.

- Encouraging investors to pool resources and risk in “Opportunity Funds” (O-Funds): For investors willing to invest in inner cities, there may be some hesitancy to make the first move. Others lack a familiarity with these distressed communities, and as a result, struggle to identify investment opportunities. The idea behind creating O-Funds is to pool resources and mitigate an individual investor’s risk. IIOA requires 90% of O-Fund investments to be put toward the financing of small businesses, real estate or infrastructure projects located in Opportunity Zones, which also means the funds can pump money into low-income areas at a scale necessary to stabilize communities and promote long-term economic growth.

- Prioritizing the most distressed communities. Low-income census tracts all qualify to be Opportunity Zones, but the legislation requires a governor to nominate the census tract before it is given the formal designation. Governors can only designate up to 25% of low-income census tracts as Opportunity Zones, which forces state and local leaders to have frank conversations and prioritize the most distressed neighborhoods. While some may argue that all low-income areas should be considered Opportunity Zones, the authors of the IIOA were strategic in limiting designation. This strategy encourages capital to be concentrated in targeted areas— an approach designed to have a more lasting impact than if investments were scattered geographically. “If everything was an Opportunity Zone, nothing would be an Opportunity Zone,” reminds Senator Scott. “We need to make sure we target the most severely impacted areas.”

If it becomes law, IIOA would create a vital new pathway for socially-conscious investors and entrepreneurs to jumpstart economic growth in some of America’s most distressed neighborhoods.

The reintroduction of IIOA is a reminder that not all communities have rebounded from the recession, and creative new approaches are needed if we want to move the needle in chronically high-poverty areas.