Back

Blog

Allentown’s special tax district too attractive for investors to ignore

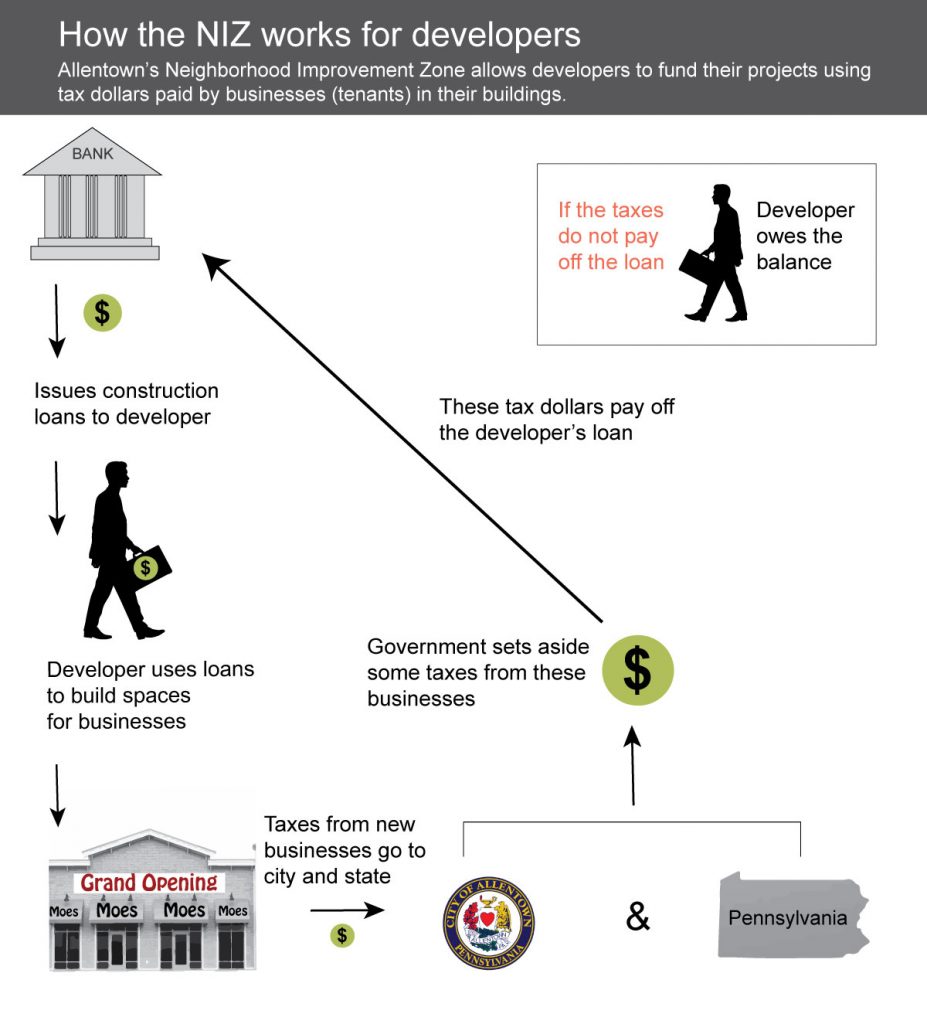

In 2009, Pennsylvania State Senator Pat Browne passed a bill that created a special taxing district to incentivize new development to support the attraction and growth of businesses in Allentown, a once vivacious industrial city that sits just Northwest of Philadelphia. The area, designated a Neighborhood Improvement Zone (NIZ), has so far benefited from the tax incentive’s unique structure and attractiveness to the private sector.

In traditional Tax Increment Financing (TIF) districts, which are used widely throughout the nation, a municipality makes loans to developers for public projects like roadway improvements, sewer infrastructure, and schools, and then collects repayment from future tax revenues generated within the district. Allentown’s NIZ district is unique in that the legislation allows the developers to invest in improvements specifically for private-sector businesses. It’s an almost unheard of arrangement, as most municipalities lack the appetite to subsidize projects that are not public goods.

The Allentown NIZ consists of 128 acres in center city Allentown and along the western side of the Lehigh River. Under the NIZ legislation, certain state and tax revenues generated by new and existing businesses within the NIZ can be used to pay debt on bonds and loans that are issued for capital improvements within the district. A special entity, the Allentown Neighborhood Improvement Zone Development Authority (ANIZDA) oversees and serves as the conduit for the financing.

The NIZ legislation is an initiative aimed at luring businesses back downtown after decades of decline. Like many Rust Belt cities, Allentown had a thriving industrial economy through the first half of the 20th century. When the coal and steel industries dried up and suburban sprawl took root, Allentown’s economy stalled and the city soon faced a multimillion-dollar deficit.

“When the malls got built, it sucked everything out like a vacuum,” says Mayor Ed Pawlowski. “This city was like any other Rust Belt city in the Northeast and Midwest. Our economy was in the tank, we weren’t seeing growth and we weren’t seeing development.”

Among the first to take advantage of the new NIZ were developers J.B. Reilly and Mark Jaindl, who also had a hand in crafting the legislation Senator Browne drafted. Reilly, an Allentown native, launched a billion-dollar effort to construct the new PPL Center arena downtown, which opened in 2014 as the new home for the Philadelphia Flyers’ minor league hockey team and the Lehigh Valley Steelhawks indoor football team. The 8,420-seat arena is also used for various concerts and events throughout the year. The 5-acre mixed-use project will consist of more than 1 million sq. ft. of development when all is said and done, with Reilly adding a 170-key Marriott Renaissance hotel, offices, retail, and market-rate apartments in and around the arena.

Reilly was very intentional with how he designed the project. Residents watched as Coca-Cola Park, built on the fringes of Allentown, helped to boost the city’s image without adding a whole lot of economic activity. “We really had to approach this differently,” Reilly says. “We had to look at this as a kind of master-planned opportunity to redevelop an urban area and really started thinking about this as creating a place.”

By offsetting his construction costs, Reilly has been able to offer tenants lower rents than they’d be able to find for Class A office and retail space elsewhere. Lehigh Valley Health Network, the regional’s largest employer, has already moved in. So has National Penn Bank, the first bank to open in Allentown in four decades. The Hamilton, a new upscale restaurant, has also moved downtown in a space where it never could have survived in years past.

With Reilly focused on the center business district, Jaindl has been working to revitalize the area along Lehigh River. The fourth-generation and lifelong Allentown resident is leading efforts to transform a 26-acre dilapidated industrial park into a $325 million project known as The Waterfront. This mixed-use project will also bring new office buildings, shops, restaurants and upscale apartments to Allentown.

“When I saw the opportunity to take part in Allentown’s renaissance I knew I had to take it,” says Jaindl. “The Waterfront will bring thousands of new jobs to the area, increase property values, generate millions of dollars of new tax revenue for the city and reintroduce the people of Allentown back to the Lehigh River.”

Between 2011 and 2015, the NIZ has generated an estimated $225.5 million in tax revenue. Revenues have more than tripled between 2011 ($22 million) and 2015 ($66.1 million). Only property taxes are excluded, which the city relies on to fund local schools. The lion’s share of this revenue – 97% – is state tax revenue that is being diverted from state coffers and sent back to ANIZDA to pay debt service on the financed improvements within the NIZ.

Despite its initial success, some, particularly those outside of Allentown, have criticized the legislation. Some view it as, “simply moving existing businesses and existing jobs from one location to another.” The way the legislation was written, only Allentown qualifies for a NIZ and accordingly, remains the only NIZ in the state.

Nonetheless, Mayor Pawlowski reiterates that the NIZ is a win-win for the city and the state. “The NIZ development is revitalizing the downtown and waterfront, and is resulting in increased revenue for the state and local taxing bodies,” – revenues that never would have been created without the NIZ because the private sector simply wasn’t investing in the area.

According to Senator Browne, the NIZ’s long-term success is easily measured. “If it’s fiscally sustainable; if we have improving schools; if we have a community that’s as productive and sustainable as the communities around it; if it’s growing; if people want to live here—then we’ll know we succeeded.”