Back

Blog

Small Business Forward Partners Create Economic Impact by Supporting a Diverse Group of Entrepreneurs

As part of its Small Business Forward initiative, JPMorgan Chase supports small businesses owned by women, people of color and veterans by investing in a dynamic cohort of entrepreneurial support organizations (ESOs). In its first five years, Small Business Forward partnered with 21 ESOs to support over 8,300 small businesses that are creating local, inclusive economic growth. The ESOs provide entrepreneurs with critical business education, connections to capital and access to markets to create more jobs.

In aggregate, across the five years, these businesses have raised $1.2 billion in capital, generated over $1 billion in revenue, created more than 24,000 jobs, and paid $760 million in wages.

2019 Impact

In 2019, ICIC evaluated 14 ESOs that represent innovative models for driving growth in underserved communities. This diverse group of organizations included ESOs focused on supporting high-tech entrepreneurs, food entrepreneurs, underrepresented entrepreneurs, and entrepreneurs in specific neighborhoods. Together, the ESOs supported the development of over 2,000 businesses that raised $336 million in capital, generated $412 million in revenue, created over 6,000 jobs (including 33 percent in local neighborhoods), and paid $266 million in wages. Thirty-two percent of the businesses they supported were owned by women, 35 percent were owned by people of color, and 25 percent were owned by veterans.[1]

Key Performance Indicators (KPIs)

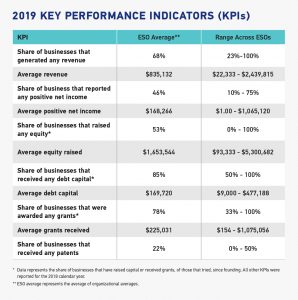

On average, most businesses (68 percent) supported by the ESOs are revenue generating and the average revenue generated is $835,132. However, just under half of the businesses, on average, are generating a net profit.[2]

In terms of accessing capital, the businesses on average were strongest in accessing debt capital (an 85 percent success rate for those that tried), followed by grants (78 percent of those that tried) and equity capital (53 percent of those that tried). However, when looking at average amounts of capital raised, more equity was raised than either debt capital or grants. For those that raised equity in 2018, they on average raised $1.65 million, compared to an average of $225,031 in grants and an average of $169,720 in debt capital. On average, 22 percent of businesses that have ever applied for a patent received at least one patent in 2018.

When interpreting these results, particularly for ESOs attempting to use this data for benchmarking their own performance, care should be taken because the data represents a diverse group of ESOs that support a wide range of businesses. This is reflected in the range of KPIs we report across the ESOs. For example, tech businesses may have longer runways to profitability and greater reliance on equity funding than businesses in brick-and-mortar retail or professional services. Therefore, the ESOs that support tech businesses may have lower rates of profitable businesses and higher rates of equity funding.

Conversely, for four of the ESOs, all of the businesses they support in our survey sample that tried to raise equity were unsuccessful (i.e., those ESOs had a zero percentage share). This may signal weak equity investor connections on behalf of the ESOs because they support businesses that do not typically utilize equity funding in early growth stages (e.g., construction, food and service businesses). This may also reflect the challenges women and entrepreneurs of color have accessing capital. Within these four ESOs, all of the eight businesses that had attempted but failed to raise equity were run by entrepreneurs of color (five of whom were women).

Similarly, for another four ESOs, none of the businesses they support in our survey sample received patents in 2018. This reflects the fact that these ESOs support businesses that are not typically associated with patentable innovations (e.g., food and other main street businesses).

Supporting Entrepreneurs through Effective Programming

The KPIs highlighted above show the impact the ESOs are having on the businesses they support. But, the evaluation goes a step further—it asks the entrepreneurs directly to rate how effective their ESOs were in helping them achieve their growth. In other words, we try to assess whether the entrepreneurs believe that their participation in the ESOs contributed to their growth.

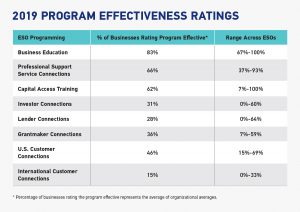

On average, the ESOs were rated as most effective in business education, followed by connections to professional support services and training around capital access. Connections to international customers was the weakest rated program offering, on average, which reflects the fact that some of the ESOs do not stress these connections.

Some ESOs providing investor, lender and international customer connections were not considered effective by any of the businesses they supported. Two ESOs were not rated as effective by any businesses for investor connections; one ESO was not rated as effective for lender connections; and two ESOs were not rated as effective for international customer connections.

These results are at least partially explained by the business stages and industries that some ESOs focus on and the resulting programming choices. For example, the ESOs not rated as effective in investor and lender connections support smaller, early-stage businesses and focus on providing business management and business space and facilities. Similarly, the ESOs rated as not effective in making international customer connections support businesses in industries such as retail and professional services that primarily serve local, regional and national customers and, therefore, the ESOs do not focus on establishing international customer connections.

We highlight best practices in programming for each ESO below in the three areas critical for small business success: business management education, access to capital and access to markets.

Management Education, Mentoring and Professional Services

Bunker Labs is a national ESO with the mission to help veteran and military spouse entrepreneurs find the quickest route to a successful business. They do this by connecting veterans and military spouses to relevant networks at the local and national level and by equipping them with the training, tools and resources they need along the way. Bunker Labs created Launch Lab Online to be the first step for anyone in the military community to test whether entrepreneurship is right for them and to learn how to get their first customer. After completing Launch Lab Online, graduates can take advantage of later stage programs within Bunker Labs.

Camelback Ventures, based in New Orleans, launched the Good Jobs Initiative in 2018 to support the development of quality jobs in high-growth industries: business services, transportation and logistics, digital media, and hospitality and tourism. The Good Jobs Initiative aims to work with young, entrepreneurial business testing different product and service offerings. The goal is to help participants identify their strengths and focus their businesses on the products or services that offer the highest potential for success.

ECDI’s Food Fort was established as a natural extension of ECDI’s desire to be Ohio’s top supporter of small businesses in need. As an organization working to provide opportunity to low-income and otherwise disadvantaged populations, ECDI recognized both the enormous potential of food-driven entrepreneurs attempting to rise up in these areas and the substantial hurdles they faced in such a high-risk industry. A decade ago, ECDI founded its first specialized food program to address the unique needs of aspiring entrepreneurs by providing them with industry training, professional guidance, and capital. The program expanded into a food cart commissary operation that gave owners storage space for their carts and gave startups the chance to test the market with cart rentals and leasing options. In addition, ECDI started to run their own food safety and inspections classes, providing hands-on technical assistance and industry coaching for their food-based clients.

The Los Angeles Cleantech Incubator (LACI) supports early stage cleantech businesses by providing full incubation programming over a two-year period. LACI provides tailored business coaching, access to investors and funding opportunities, and access to business facilities to help startups accelerate the commercialization of clean technologies. LACI also works towards transforming markets by developing key partnerships in transportation and energy sectors and enhancing communities through workforce development and other programs.

Similarly, Connect was established to strengthen high-tech and life sciences clusters in San Diego by developing more local startups. One of the first accelerators in the U.S., Connect’s flagship program is Springboard, an individualized program leveraging the organization’s broad network of mentors with business, marketing and finance expertise, as well as experienced entrepreneurs, to guide startups. Connect has built an extensive, highly qualified network of mentors, including more than 140 active individuals whose backgrounds include successful entrepreneurship and industry and academic expertise. This year, Connect merged with another long-standing nonprofit organization, the San Diego Venture Group, in order to best serve entrepreneurs and startups throughout their growth journey, from early stage through capital raise. Connect produces a suite of curated educational programs and events aimed at helping companies thrive so they can make a meaningful impact on the economic development of San Diego.

The Latinx Incubator is the result of an innovative partnership between the Illinois Hispanic Chamber of Commerce (IHCC) and the nationally recognized 1871 technology incubator. The mission of the Latinx Incubator is to grow the pipeline of Latinx and diverse entrepreneurs participating in and contributing to the Chicago tech and innovation economy. During the course of the 12-week cohort program, founders have access to co-working space within 1871 and its member benefits; tailored educational sessions and workshops to help their business gain traction; and IHCC and 1871’s network of mentors. The program culminates in two exclusive events. The first is a private pitch with key stakeholders from 1871, IHCC, and the investment community. The second is a capstone Demo Day with the Chicago tech ecosystem.

Also in Chicago, the Women’s Business Development Center’s ScaleUp initiative supports established businesses through a nine-week cohort program. WBDC’s ScaleUp program originated as an SBA-funded economic development program for women-owned small businesses and is now a regular part of WBDC’s business support offerings. ScaleUp helps small business owners acquire business and financial acumen for sustainable growth. Based on feedback that WBDC has received from participating entrepreneurs, WBDC has intentionally designed the program to provide a support network of fellow entrepreneurs and opportunities for personalized, one-on-one experiences with staff and mentors. The addition of these high-touch program elements to the business growth curriculum is intended to help address the isolation that entrepreneurs can experience while running small businesses.

Access to Capital

Hillman Accelerator in Cincinnati is focused on supporting tech-based businesses founded by underrepresented entrepreneurs. Hillman supports its businesses through a cohort-based education program and by providing $125,000 in capital in exchange for a seven percent equity stake. Through this model, Hillman is seeking to address the venture capital funding gap faced by women, people of color and other underrepresented founders.

ECDI’s Capital for Construction program is entering its fourth year of operations. To date, the program has served more than 350 small construction subcontracting firms owned by people of color, and disbursed more than $2.5 million in loan capital to support the stability and growth of these firms. ECDI developed the program, which incorporates industry-specific training, one-on-one technical assistance, access to markets, and access to working capital through ECDI’s Mobilization Loan, to level the playing field for these small business owners.

Rev1 Ventures supports the technology startup ecosystem in its Columbus, Ohio region and beyond through a $100 million investment portfolio and investor startup studio. Rev 1 connects its portfolio of companies to advisors, vetted service partners, first customers and strategic corporate partners. By operating as an active seed investor, Rev1 can help direct critical investment capital to early stage businesses. Rev1 also operates an innovation center, Rev1 Labs, which currently houses more than 50 companies.

Propeller, in New Orleans, grows and supports entrepreneurs that tackle social and environmental disparities in community economic development, education, health, food and water. A core component of this work is Propeller’s Impact Accelerator, an interactive four-month accelerator program that provides startup and growth entrepreneurs with coaching, community building, curriculum, and technical assistance. Propeller supports access to capital through PitchNOLA (a pitch based business award) and its Social Venture Fund (a $1 million loan fund). The Social Venture Fund provides loans between $20,000 and $100,000 to entrepreneurs of color and enterprises working in Propeller’s target impact areas. Propeller’s incubator facility provides small businesses, nonprofits, and community members with the space to connect and collaborate as they grow ideas, with more than 60 companies and 30 individuals working out of the co-working facility on a daily basis.

Expanding Markets

Through its Retail Boot Camp and SWOT City programming, Detroit-based TechTown helps local businesses access new markets, which also strengths local retail markets in Detroit. Both programs serve entrepreneurs throughout the city of Detroit, with the goal of stabilizing and growing local commercial districts. TechTown’s Retail Boot Camp focuses on helping aspiring entrepreneurs who intend to launch brick-and-mortar business in Detroit bring their businesses to market through a 10-week intensive program covering all aspects of opening a business and six months of personalized coaching. The SWOT City program targets more advanced entrepreneurs – often graduates of the Retail Boot Camp – and provides customized coaching.

Also in Detroit, Eastern Market supports food-based business through its Detroit Kitchen Connect program. The program provides participating businesses with access to licensed kitchen facilities, training on food regulations and licensing, as well as connecting them to new customers at Eastern Market’s renowned weekly food markets. Several food markets take place each week and, in the busy season, can attract up to 225 vendors and 40,000 customers in a single day.

Based in Newark, the New Jersey Innovation Institute’s Health IT Connections program aims to support the growth of regional health information technology (IT) businesses. The Health IT Connections program supports growth-stage businesses through executive coaching, matchmaking to customers and strategic partners, and provides networking opportunities for the executives enrolled in the program. One of the key challenges that business face prior to participation is finding and acquiring customers in the “payer and provider” space. Much of the support that the program provides is centered around making connections for its participants and helping to form business relationships, including critical customer connections, through targeted matchmaking events held throughout the year.

Creating access to more international markets is a strong suit for BioSTL. Based in St. Louis, BioSTL was founded to support the city’s innovation economy in industries including agriculture, medicine, healthcare, the biosciences sector and other key innovation sectors. GlobalSTL is a business development partner that delivers customers and strategic opportunities to international startups looking to enter the U.S. market and serves as a navigator to the city’s corporate and innovation ecosystem. The GlobalSTL program identifies potential companies, conducts outreach to communicate the benefits of a St. Louis location, hosts networking events and facilitates other connections with key individuals and organizations within the St. Louis ecosystem. For companies that decide to locate in St. Louis, the GlobalSTL program also provides support for the transition, including finding business space, recruiting employees and long-term business support.

Building on Success and Creating Stronger Ecosystems

As the Small Business Forward program has evolved, there is increased focus not just on supporting individual ESOs, but on creating stronger entrepreneurial ecosystems for underrepresented entrepreneurs. To that end, two new programs were launched under the Small Business Forward umbrella: the Entrepreneurs of Color Fund and Ascend. The Entrepreneurs of Color Fund was initially launched in Detroit in 2015, in partnership with the W.K. Kellogg Foundation and Detroit Development Fund, and has since expanded to San Francisco, Greater Washington, D.C., the South Bronx and Chicago’s South and West Sides. The Entrepreneurs of Color Fund provides access to capital for small businesses owned by people of color by providing capital for community partners to lend and to provide technical assistance.

The Ascend initiative was created by the University of Washington Foster School of Business’s Consulting and Business Development Center to help grow businesses owned by people of color, women, veterans and inner city businesses. Now operating in 13 cities, Ascend brings together collaborations of local partners to provide underrepresented entrepreneurs with access to what the program calls the “three Ms”: Management Education, Money, and Markets. Previous ICIC research has analyzed the early impact of the Ascend program.

Partnerships within the group of ESOs we evaluated are also a promising potential path for addressing challenges faced by individual organizations. For example, LACI partnered with Bunker Labs earlier this year to learn from their expertise on the unique barriers faced by veteran entrepreneurs and to leverage Bunker Labs’ unique network for recruitment. Since one of LACI’s goals is to create a more inclusive and representative green economy by supporting underrepresented entrepreneurs (including LGBTQ entrepreneurs), LACI hosted an event called “Taking the Lead 2.0” in May 2019 to learn directly from entrepreneurs in the veteran and LGBTQ communities about the barriers they face in entrepreneurship. The event helped LACI and Bunker Labs strengthen the ecosystem of support for all veteran entrepreneurs, who cited unique challenges around building networks and accessing capital.

As the ESOs continue to innovate, the Small Business Forward program is also poised to support their growth and continue to expand opportunity for underrepresented entrepreneurs in the communities that need it most.

[1] KPI data represents averages for each ESO and averages across the ESO averages.

[2] This is the share of the full sample of businesses across all ESOs that responded to the ICIC survey.