Back

Blog

Duluth’s Industrial Legacy is Also a Key to Future Equitable Growth

Written by Zach Nieder and Kim Zeuli

Duluth, Minnesota is a resurgent city that has garnered national attention for its vibrant maker districts, natural amenities, and start-ups that are revitalizing the city’s image and economy. Loll Designs, Epicurean, and the aircraft maker Cirrus all call Duluth home. However, the city also faces significant challenges to achieving sustained, equitable growth. As measured by population, employment, and economic growth, Duluth lags behind many of its peer cities. Persistent economic inequality is also an ongoing struggle, with poverty concentrated within several neighborhoods.

As is the case with many rust belt cities, Duluth is grappling with how much it should continue to rely on the industrial sector for future growth. Is the city’s proud industrial legacy a key to future economic prosperity, or should it be relegated to history? The Initiative for a Competitive Inner City (ICIC) was engaged by Duluth Seaway Port Authority (DSPA) to undertake a comprehensive study that would help the city answer this question. DSPA has been a leading advocate for industry in the region since its founding in 1955.

An Historic Port Town that has Retained Competitive Assets

The abundance of natural resources in the region, including iron ore and forests, combined with rail and shipping transportation options, helped Duluth grow into a prosperous industrial city at the turn of the twentieth century. The city’s location on Lake Superior and its large port gave it a competitive advantage in transporting these goods. Today, the Port of Duluth-Superior is the largest tonnage port on the Great Lakes and continues to rank among the top 25 ports in the U.S., handling an average of 35 million short tons of cargo and hosting nearly 900 vessel visits each year.

DSPA owns and operates multiple properties, including the Clure Public Marine Terminal and the Duluth Airpark, a 300-acre light industrial park located near the Duluth International Airport that is home to Cirrus facilities, GPM, ProPrint and more than 40 other companies. In 2017, the Canadian National (CN) Duluth Intermodal Container Terminal opened on the Clure Public Marine Terminal, providing new opportunities to expand both domestic and international trade. Four major freight railroads also serve Duluth: Burlington Northern Santa Fe, Canadian National, Canadian Pacific and Union Pacific.

Approach

To capture the breadth of the industrial sector in Duluth, we defined an aggregate industrial sector that includes both traditional and contemporary industrial businesses (e.g., construction, manufacturing, transportation, publishing, telecommunications, data processing, aviation and breweries).

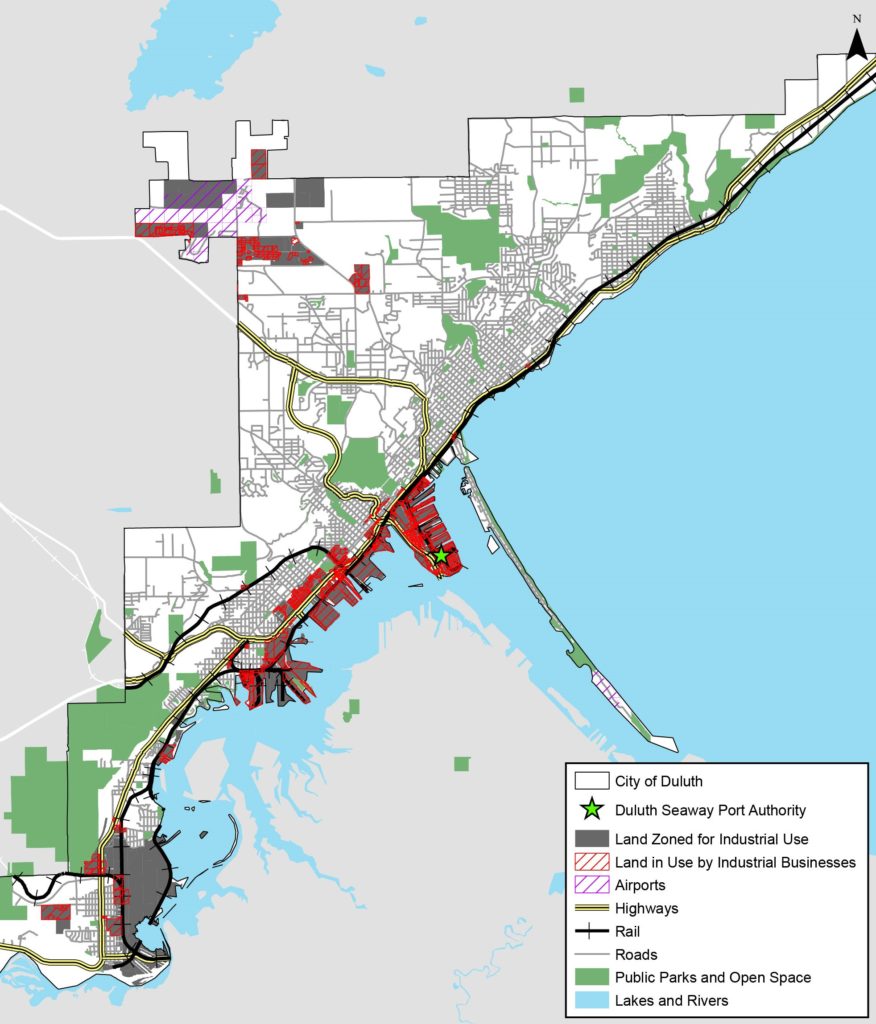

Our analysis included a robust analysis of industrial land use in Duluth, IMPLAN modeling to estimate the current economic and fiscal impact of the aggregate industrial sector, and a cluster analysis. Finally, the study also included a close review of four peer cities to help provide insight into policies and practices that could be potentially adopted in Duluth.

Our analysis relied on public and proprietary data, a broad literature review that included planning and economic development studies, and interviews with 51 experts from different economic sectors in the city. The study was guided by an advisory committee made up of the DSPA project team and 11 other community members representing diverse organizations from the public and private sectors.

Key Findings

1. The industrial sector continues to drive significant economic growth in both Duluth and the surrounding region. In 2016, there were 9,449 industrial jobs, which supported an additional 7,353 jobs in Duluth. The industrial sector created a $3.8 billion impact on Duluth’s economy and generated $236.4 million in state and local tax revenue. An estimated $107.3 million of the tax revenue went to local government coffers.

2. While on the surface there seems to be a sufficient amount of vacant industrial zoned land in Duluth to support industrial sector growth, 20 percent of vacant industrial zoned land is not developable because of low elevation. Another 21 percent includes three large brownfield sites. Much of the remaining 1,600 vacant industrial acres is challenging to redevelop due to known or suspected brownfield issues, limited parcel size, limited access, soil quality, and a host of other issues. If suitable industrial land is not readily available or is too costly to develop in the city, existing businesses that are expanding may feel forced to move out of the city. Likewise, without sufficient development-ready sites, Duluth will not be able to compete with other areas in attracting new industrial businesses to the area.

Industrial Zoned Land Currently In Use by Industrial Businesses in Duluth

3. While the rest of the economy is five times larger than the industrial sector in Duluth, on a per job basis the industrial sector supports a proportionately higher share of jobs and generates three times more local tax revenue per job. Our analysis also suggests that maintaining industrial businesses on industrial zoned land would create more jobs and drive greater economic growth than most alternative uses, including housing, green space and retail or service-sector businesses.

4. Duluth has ten strong and emerging competitive industrial clusters, which suggests that industry remains a competitive advantage for Duluth and the region and has the potential to continue to drive economic growth in the future. The clusters include Water Transportation, Aviation, and Transportation and Logistics. The majority of jobs in these clusters are accessible—requiring less than a Bachelor’s degree—and offer competitive wages. The industrial sector also supports the growth of other business sectors in Duluth, including Health Care, Education and Tourism. If the industrial sector expands, these other sectors will grow as well.

Four Priorities for Catalyzing Industrial Growth in Duluth

1. Supporting and growing the industrial sector in Duluth will require coordinated economic development strategies that should recognize the importance of industry alongside other sectors of Duluth’s economy.

2. Duluth is fortunate to have many industrial assets. Targeted investment in “high-return” industrial assets will spur growth in both the industrial sector as well as Duluth’s overall economy.

3. While clusters (groups of closely related industries co-located in a specific geography) occur organically and reflect the unique assets and competitive advantages of a region, cluster growth can be accelerated and the impact maximized through strategic interventions to address issues such as workforce development, support of entrepreneurs, or zoning.

4. Finally, there is a need to develop policies that create a more supportive business environment for industry. Duluth needs to be competitive to attract, retain and expand industrial businesses. Local policies, from land use to wastewater and electricity rates, can have a significant impact on the industrial sector.

Read the full report: An Assessment of the Industrial Sector as a Driver of Future Growth in Duluth