Back

Blog

Benchmarking Metrics for High-Tech Incubators and Accelerators

Despite the proliferation and growing support for incubators and accelerators, especially in the technology sector, data and research measuring their performance is surprisingly limited. Some incubators and accelerators simply don’t capture any data on their programs or the businesses they support. And those tracking robust performance metrics often lack benchmarks to assess whether they are stacking up to their peers.

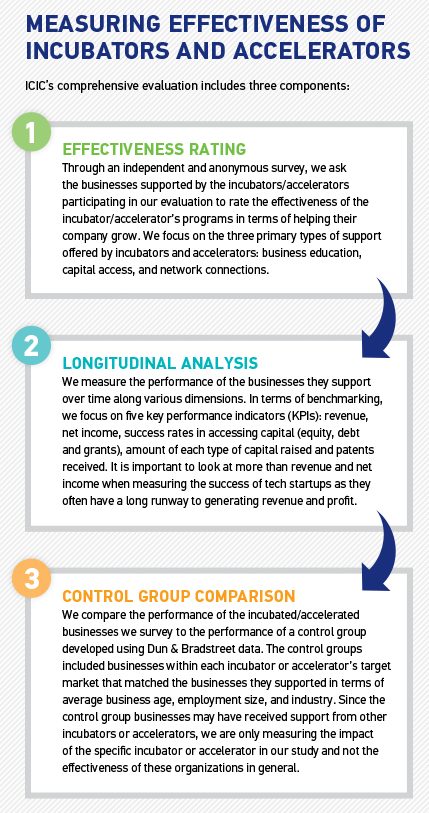

As part of the JPMorgan Chase Small Business Forward initiative, ICIC is working to close this performance measurement gap and understand what effective high-tech business incubation looks like in the U.S. We share our approach for evaluating the performance of high-tech incubators and accelerators below as a potential model for others. We also offer a summary of the data we collect as a starting point to help organizations benchmark their performance.

As part of the JPMorgan Chase Small Business Forward initiative, ICIC is working to close this performance measurement gap and understand what effective high-tech business incubation looks like in the U.S. We share our approach for evaluating the performance of high-tech incubators and accelerators below as a potential model for others. We also offer a summary of the data we collect as a starting point to help organizations benchmark their performance.

Our evaluation, now in its second year, captures data from eight high-tech incubators and accelerators located in different cities across the country. They support businesses in general technology, biotechnology, cleantech, health IT, and water technology. Data from the first year of evaluation was summarized in an earlier blog.

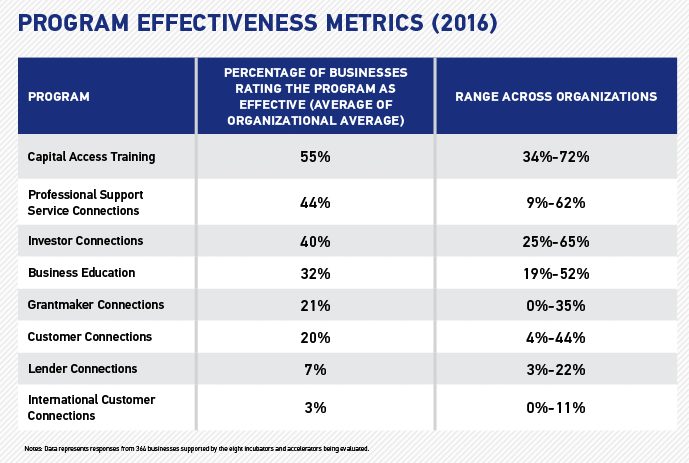

Benchmarks for Program Effectiveness Ratings

The program effectiveness ratings in the table below highlight performance variations across incubators and accelerators. We calculated the ratings from the businesses within each incubator/accelerator (versus for the entire business sample) to allow for organizational benchmarking. For example, across all organizations, 32 percent of the businesses they support (on average) rate the incubator/accelerator as having effective business education programs. The average for each organization varied, from 19 percent to 52 percent.

On average, the incubators/accelerators are rated as most effective at capital access training, professional support connections (e.g., legal, financial) and investor connections. Connections to international customers and lenders are the weakest areas across all incubators and accelerators. Less than one-third of the businesses report that programming related to business education, connections to grant makers and connections to customers are effective in helping them grow their business.

When comparing the effectiveness ratings across organizations, we find a relatively large difference. The most significant difference is for professional support services—the rating varied from nine percent to 62 percent.

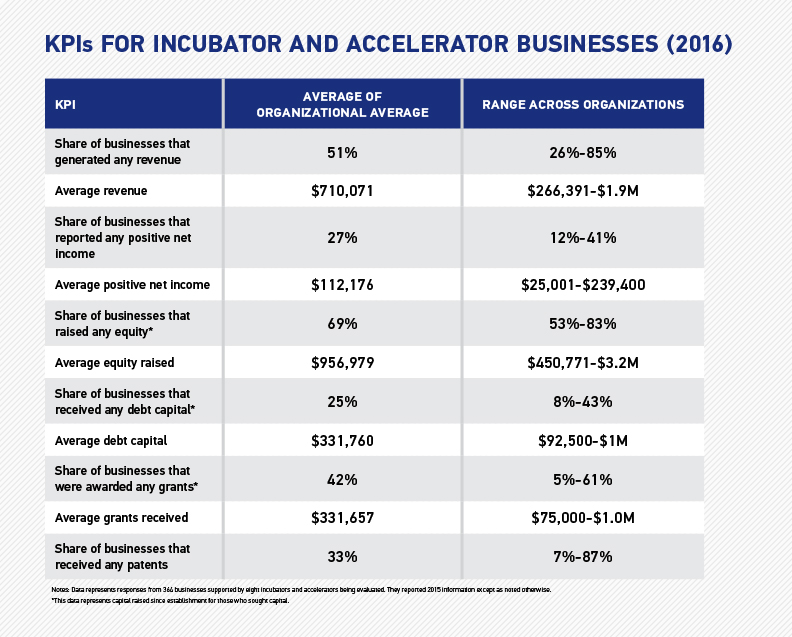

Benchmarks for Key Performance Indicators (KPIs)

The KPIs summarized in the following table represent data from 364 businesses supported across the eight high-tech incubators. They are generally small, young startups. On average, they have 6.6 total employees, 75 percent are less than five years old and nearly 80 percent consider themselves to be concept, seed, or early-stage businesses.

We calculated the KPIs for the businesses within each incubator/accelerator (versus for the entire business sample) to allow for organizational benchmarking. For example, across all organizations, 51 percent of the businesses they support (on average) are generating revenue. The average for each organization varied, from 26 percent to 85 percent.

On average across all organizations, the businesses reported earning over $700,000 in 2015, but this varied across incubator/accelerators—from an average of just over $266,000 to $1.9 million. Just over one-quarter of the businesses, on average across all organizations, reported making a profit. Of the businesses seeking capital, they were most successful at raising equity (69 percent on average), which is not surprising given that they are being supported by incubator/accelerators, which generally have strong ties to investors, especially in the case of accelerators.

Forty-two percent, on average, were also successful at securing grants. The range of 5-61 percent highlights the fact that some incubators and accelerators do not support businesses in finding and securing grants, although it is clearly an important source of capital for some businesses. On average, a third of the businesses across all organizations received patents in 2015—with 87 percent of the businesses in one incubator/accelerator receiving patents. This demonstrates the potential effectiveness of the organizations in spurring high-tech innovation.

Control Group Comparison

For all eight incubators and accelerators in our study, the businesses supported on average outperformed their control groups in terms of revenue, but none outperformed their control groups in terms of net income. However, the differences in performance may be due to net income reporting requirements for Dun & Bradstreet that differ from ICIC’s. The share of businesses outperforming the control group for each organization ranged from 23-46 percent for revenue and 13-64 percent for net income.

Takeaways

The results of our comprehensive, three-part evaluation suggest that incubators and accelerators are important interventions to support the growth of high-tech entrepreneurs. Our evaluation model is helping leaders in the high-tech business incubation industry deepen their understanding of effective programming and think about how to benchmark success.

Across all incubators and accelerators, the business they support report the need for improvement in terms of business education, and support in developing connections to lenders, grant makers, and networks of domestic and global customers.

Since most of the businesses supported by the grantee organizations are small, young startups (less than five years old), it is not surprising that on average, over half are earning revenue, but the majority (73 percent) are not yet earning profit. Given that the businesses are being supported by incubators and accelerators that have investor connections, it is also not surprising that, on average, the businesses have more success raising equity than in accessing debt capital.

It is important to note that variations in effectiveness ratings and KPIs may be due in part to industry differences and may not fully reflect organizational effectiveness. Businesses in incubators focused on internet startups, for example, are awarded patents far less than those in the biotech industry. Robust benchmarks for different types of incubators and accelerators still need to be developed. In the meantime, however, the benchmarks we offer can be a useful starting place for organizations interested in measuring their performance against their peers.